By Zina Kumok, Money coach

Zina Kumok is a Certified Financial Health Counselor and a personal finance speaker and author. She has been featured on leading financial sites including Nerdwallet, Investopedia, Business Insider, Prudential, and more.

Zina Kumok is a Certified Financial Health Counselor and a personal finance speaker and author. She has been featured on leading financial sites including Nerdwallet, Investopedia, Business Insider, Prudential, and more.

In this guide, Zina discusses the lesser-known financial incentives of a home solar installation and who is best-suited for this investment.

The cost of a solar energy system has dropped significantly in recent years. Thanks to a wealth of financial incentives from states, utility companies, and the federal government, solar energy is more affordable than ever!

Keep reading to learn how solar panels can save you money — and pave the way to a cleaner, more sustainable energy future.

Here are the boxes I check off with my clients:

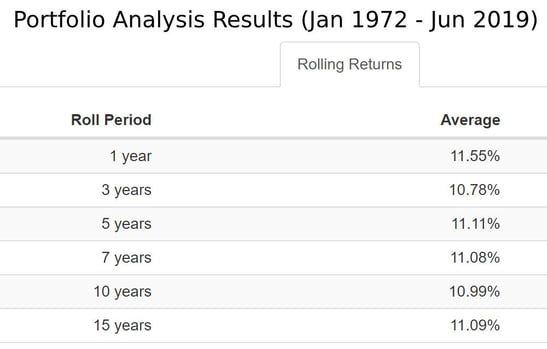

One question most of my clients have never previously considered is this: how does an investment in solar compare to traditional investments?

The comparison between a solar investment and traditional investments includes other critical factors that I cover in this guide. As always, be sure to talk to your financial advisor for help deciding which financing and investment solutions are best for you.

*This is a sponsored post written on behalf of Freedom Solar. All opinions are my own. — Zina Kumok